[tweet][digg][stumble][Google][pinterest][follow id=”DER29709692″ size=”large” count=”true” ]

Five months after the privatisation of the power sector in the country, there are indications that the dream of stable power in Nigeria is still a far cry due to debilitating factors still afflicting the sector, writes Olisemeka Obeche.

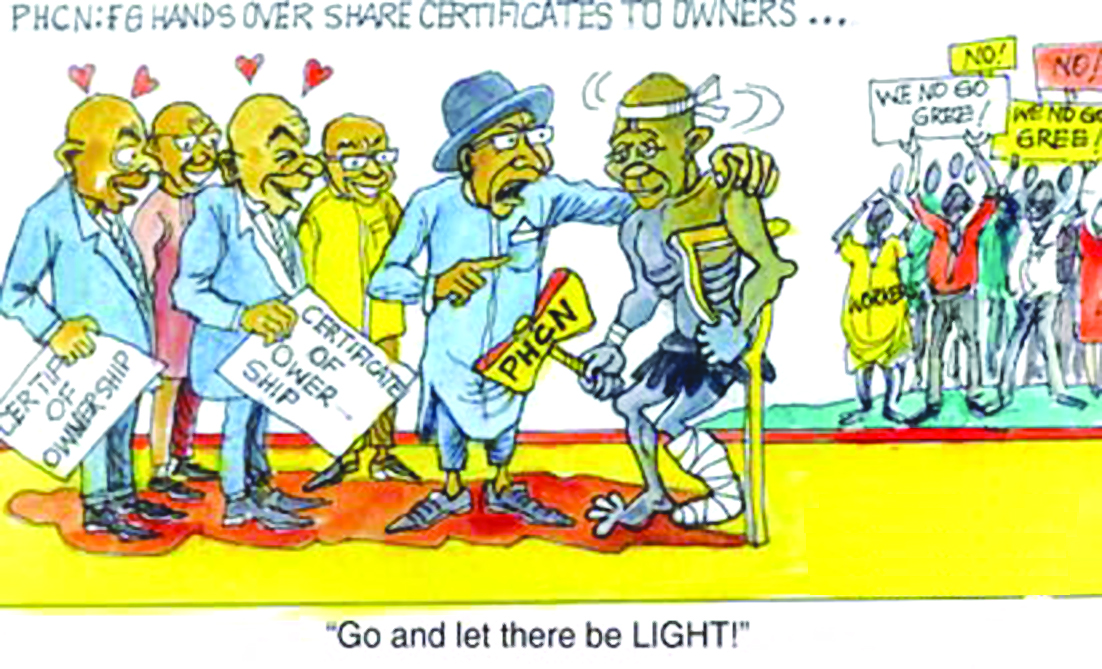

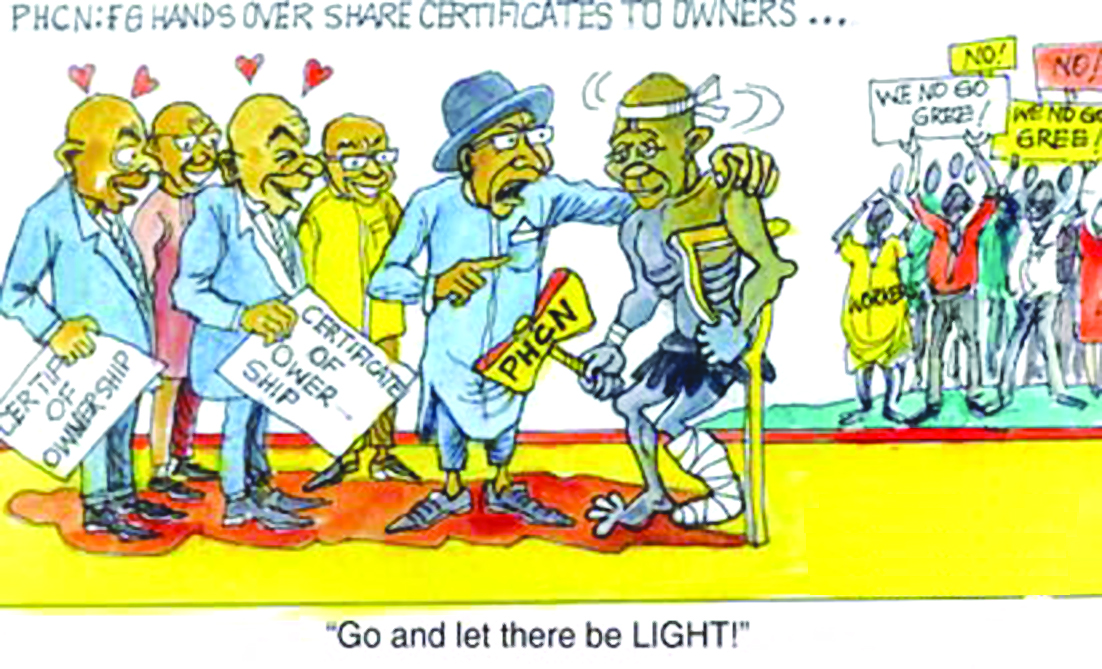

Following the completion of the privatisation of the power sector, precisely on November 1, 2013, the day the power holding company of Nigeria (PHNC) ceased to exist, many Nigerians heaved sigh of relief. For them, the emergence of 16 power distribution companies (Discos) and generation companies (Gencos), would improve power supply.

However, five months after the privatization of the power sector, the expectation of stable power supply appears to be a forlorn hope. Investigations by TheEconomy reveal that there has been no significant improvement since the handover of the PHCN to private investors. Indeed, reports from across the country indicate that succour has not come as epileptic power supply is still the order of the day.

To many electricity consumers, instead of enjoying steady power supply, the new private investors expect them to even pay more for service they do not enjoy.

Mrs. Blessing Amadi, resident in Lagos said life in her neighbourhood was a lot better before the privatisation exercise. “We were relieved when the federal government completed the unbundling of the PHCN in November last year. We were hopeful that power supply would improve. But what we are witnessing now is really disappointing,” she said.

According to her, the cost of fuelling her generator has soared astronomically in the last few months. She however urged the federal government to keep the various electricity firms on their toes so that consumers can get value for money on their electricity bills.

Mr. Obafemi Giwa, resident at Abule Egba in Lagos, complained that power supply has gone from bad to worse. “The electricity supply is getting more erratic. The new investors are treating us badly, yet they send crazy bills to the consumers. During the old PHCN management era, I paid about N2,000 monthly but now the successor company has jerked up the bill to N6,000 monthly. They did not improve their service delivery, but they are quick to raise the tariff. That is quite unfair on the consumers,” he said.

For Sunday Akpan, a barbing salon operator in Surulere, Lagos, the power situation in his area has not improved since the handover to private investors. He said he was surprised the successor companies have even increased the service charge for pre-paid metre by 100 percent, from N750 to N1,500 without improving their services. “We were happy when we learnt that PHCN has given way to private investors. We thought we were in for better days, but in the last one month, we have not seen any improvement. We used to have about 10 hours of electricity daily, but now we hardly have up to four hours,” he said.

Mrs. Doyin Oladipo, who owns a small scale frozen food shop in Akute, Ogun State expressed fear that her business may collapse due to dwindling electricity supply. “Since the first week of November, I have been losing, as the frozen foods easily get spoilt due to poor power supply. I lost four cartons of chicken and three cartons of turkey worth about N40,000 due to poor power supply. The bill has also increased. How can a small shop like mine pay as much as N8,500, as against the N2,000 I used to pay before the privatization of the power sector?,” she queried.

The situation in Lagos is not different from other parts of the country. In Owerri, the Imo State capital, the problem of power outage has dealt a big blow on artisans who rely on regular power supply for their businesses. For instance, Emeka Opara, a welder in Owerri said despite poor power supply, he was asked to pay exorbitant bill. “I thought the handover of PHCN to the private sector would improve my business. I am disappointed because apart from the almost non-existent electricity, the bill is scary. I am required to pay N6, 400, but before now I used to pay N2,500,” he fumed.

In virtually all the states of the federation, the story of poor power supply is the same as many are yet to witness any significant improvement in power supply.

Although there are a few places where residents confirmed that electricity supply had improved, like Obawale in Iju and Ikorodu area of Lagos, many argue that under the private investors there has not been any improvement.

Thus, contrary to public expectations and government’s projection, the privatization therapy which saw multi-trillion naira public assets sold to private investors for N528 billion has not resolved Nigeria’s electricity crisis. Although the federal government has given the private power firms June this year as deadline to improve electricity supply, there are indications that the existing infrastructure and prevailing systemic challenges may not permit the projected quantum leap. And going by the estimation of some experts, it could take up to five years of unprecedented stride for the nation to overcome its chronic power crisis.

Discos’ teething problems

With the several challenges such as shortage in gas supply to thermal power stations, systems breakdown, weak transmission (power-wheeling) capacity and transmission loses as well as shortfall in revenue generation, it would require a miracle for the new investors to turn-around the power situation.

Also likely to hamper the ability of distribution firms to improve power supply soon is the shortage of funds at their disposal coupled with revenue shortfalls. Sources told TheEconomy that improvement on the existing infrastructure and service delivery has so far remained a herculean task for the new distribution companies. According to source, without significant financial lifeline, the new investors do not have the financial capacity to meet the capital expenditure needed to transform the distribution sub-sector of the industry. “There is no much difference between this private regime and the defunct PHCN as we are still working with the old method and reduced workforce. They even reduced our salary, an indication that they don’t have the kind of money expected of them to change this place”, disclosed the source who pleaded for anonymity.

Mr. Olugbenga Adesanya, an energy economist, noted that most of the Discos buyers were struggling to add value to the firms they bought because of the faulty parameter employed by the privatization committee in assessment and award of preferred bidders. According to him, the privatization handlers concentrated on finance alone, neglecting the assessment of technical and managerial competencies. “Why should you just sell government enterprises based on mere figures? Most of them met the deadline for payment, but it is like somebody who bought a flashy car but does not know how to use it. Some of them are now busy shopping for technical partners across the world. Regrettably, they were even going to countries as poor as Zambia to fetch technical experts. So, what is actually happening is like putting the cart before the horse,” Adesanya said.

Many believe that since the Discos are still operating with a team of workforce largely comprising former PHCN staff, it is tantamount to retaining ‘old wine in a new skin’. “You can’t expect much improvement from their services when you have the same set of people that operated the PHCN with impunity in the same system. Although, with tight monitoring and re-training, their level of efficiency and dedication could improve, we are yet to see such now,” says Mr. Ephraim Odia, an energy analyst.

The new owners are equally grappling with inherited systemic problems some of which may not be easily discarded due to their sensitive nature. For instance, issues such as estimated billing (N750 which has now been increased to N1, 500) and fixed service charge remain highly controversial. However, the private investors may not be quick to jettison this due to shortfalls in revenue inflow.

Industry players are of the view that with the refusal of the National Electricity Regulatory Commission (NERC) to sanction possible tariff hike at the expiration of the current Multi-Year Tariff Order (MYTO-II) in April, investors may create a more reliable billing system that could guarantee them return on investment.

Dr. Jamil Gwamna, managing director of Kano Electricity Distribution Company, is one of the new players who faulted the market rules, particularly the MYTO. He argued that until the loopholes in the rules were addressed, investors would find it difficult to recoup their investment. “How on earth will I make money? We are not even near the assumption of MYTO because MYTO says I should be allocated eight per cent of the total generation capacity, which means if the generation is 2000mw, Kano should be allocated at least 160mw. Our allocation was 80mw and out of that 25mw is going to Niger Republic. So, I think these are serious issues we have found on the ground and they should be addressed urgently,” he said. According to him, electricity theft and inappropriate billing contribute to loss of revenue to Discos. “Electricity consumers are not billed correctly and there are other contentious issues affecting revenue stream of the power distribution firms. And until these are tackled the firms cannot really make the kind of investment required to turn around the industry,” he added.

Kola Balogun, chief executive officer, Momas Systems, however, insists that the best way to tackle electricity theft and poor billing is to create revenue efficiency collection platform that guarantees seamless payment to consumers. “We don’t have an easy way for electricity consumers to pay their bills; and that is enough to actually put some of them into thinking of by-passing payment of bills. So, we need a very healthy downstream platform,” he said.

However, Mr. Sam Amadi, chairman/CEO of the National Electricity Regulatory Commission (NERC) attributed the drop in power supply to teething problems associated with the transitional period from public to private sector regimes. He promised that things would normalize soon.

Gas supply quagmire

Despite having the capacity of generating more than 4,500mw of electricity, the country’s total electricity generation has continued to hover below 3,900mw megawatts in recent times. For instance, a recent report by the Presidential Task Force on Power (PTFP) shows that total electricity generation as at mid-March 2014 stood at 3,707.1mw as against the (peak) 4,517.6mw generated in December 2012. And the major reason for the persistent drop in power generation is inadequate gas supply to power stations which government attributed to vandalism and occasional shut down of plants for repairs.

Chairman of the (PTFP), Mr. Reynolds Dagogo-Jack said that between May and November 2013, the country witnessed 12 major attacks on five critical gas pipelines leading to an average capacity loss of about 1,880mw of electricity. Such attacks on gas pipelines later dubbed ‘sabotage’ by the NNPC culminated in almost seven months of interruption in gas supply.

Despite the instant relief many felt after the repair of the pipelines, the threat by the Movement for the Emancipation of Niger Delta (MEND), that it will damage the pipelines again is a clear indication that the solution to the crisis is still far.“Nigerians should not expect improvement in power supply through gas pipelines until the root issues that led to militancy in the Niger Delta have been addressed,” MEND warned in a statement signed by its spokesperson, Jomo Gbomo.

Although government is yet to make public its strategy for tackling the rising trend of pipeline vandalism that has equally culminated in the loss of crude oil worth hundreds of billions in addition to the power supply challenge, experts say a holistic solution is required. For Comrade Joe Ajaero, secretary general of the National Union of Electricity Employees (NUEE), gas-supply crisis will continue to hamper the country’s power generation until government diversifies power generation stations from gas. “Before now, we as unionists have tried to make presentations on how to diversify our source of energy. We have wind, hydro, thermal, as well as bio energy sources, but it appears that government is only interested in gas as the main source of energy supply for electricity generation in the country.

“The concentration on gas energy source alone is part of the problem because we have close to 80 percent of the power plants that are dependent on gas. And as long as these pipelines are not adequately protected, the problem would continue to reoccur,” he added.

Mr. Fashola Charles, managing director of Seacorf Engineering Limited, believes the way forward is to tackle the issue of sabotage along the supply chain. “There is the need for government to sanction all contractors or companies saddled with the responsibility of supplying gas to Independent Power Project (IPP) stations, but failed,’’ he said.

Even the PTFP chairman, Dagogo-Jack acknowledges the challenge gas supply poses to the realization of the privatization goal. “Gas inadequacy and pipeline vandalism constitute the greatest risks to service delivery and market sustainability. The continued delay in migrating to a fully-contracted gas market regime remains a major impediment to incentivising both upstream investment decisions and the maintenance of existing assets,” he said.

He offers a way out: “Going forward the Nigerian Petroleum Development Company (NPDC’s) effective delivery of its gas projects is critical to meeting the domestic gas demand since they are inheriting many of the JV gas assets previously operated by Shell Development Company (SPDC). The completion of the OB3 East-West link – line is critical to supply optimisation from 2017.”

Obsolete infrastructure:

Another major factor bedeviling Nigeria’s power sector transformation is weak transmission infrastructure. Although, going by power roadmap projection, the country’s power generation ought to have grown above 12,000mw, experts say the existing national transmission network does not have the capacity to wheel-out more than 5,000mw. “So, even if the National Integrated Power Projects (NIPPs) have come on stream and we have up to 10,000mw generating capacity, the existing network cannot distribute more than 5,000mw because our national transmission network is still based on archaic radial technology,” Mr. Adesanya, an energy expert said.

According to him, until the government builds a super-highway transmission network as contained in the Power Sector Roadmap launched by President Jonathan in 2010, Nigeria’s quest for stable electricity would remain a pipe dream.

“I believe we should work towards that as a matter of national policy urgency. That is very necessary because even if the generating companies are working at optimal capacity at all times, without standard transmission network, much of the power would be lost. Sometimes up to 45 percent of generated electricity is lost to this leakage in Nigeria. And what that tells you is that for every 100mw of electricity produced, about 40-45 megawatts is lost between transmission and distribution transits,” he said.

In August last year, the Minister of Power, Professor Chinedu Nebo, had said that much of the N1.6 billion proceeds from sale of independent power projects will go to finance efforts to tackle transmission problems. “Government is poised to tackle the problem of transmission and as such is committing majority of the about N1.6 billion proceeds to be realized from the sale of NIPPs to it, to ensure that there is enough wheeling power provided for the distribution of every megawatt of electricity generated,” Nebo said.

The new funding package came to the fore almost three years after President Jonathan reportedly gave the nod for the construction of the new 700KV National Super Grid at a projected cost of $3.5billion.

[divider]