President Bola Tinubu, yesterday, in Paris, France, said ongoing reforms, starting with removal of fuel subsidy and streamlining of exchange rate, will be sustained for a more competitive economy that attracts Foreign Direct Investment (FDI), urging investors to take advantage of opportunities in Nigeria.

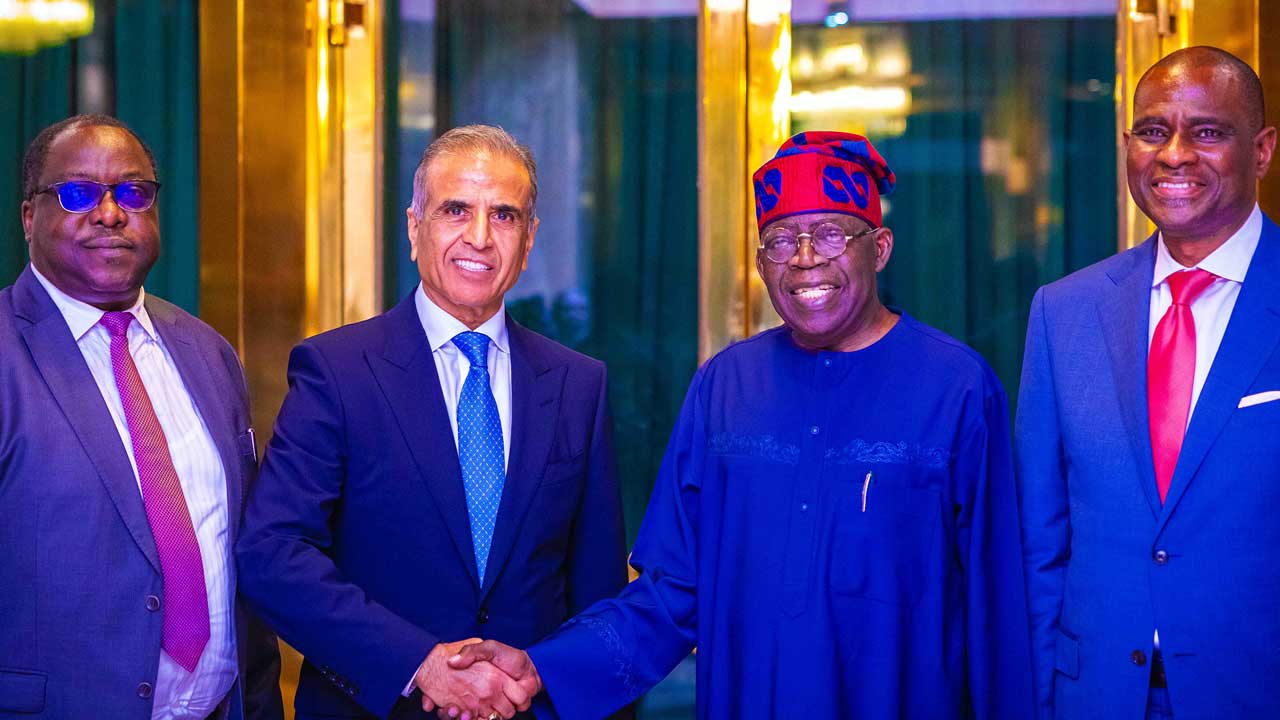

“We are ready for business, prepared to welcome investments,’’ he said while receiving President and Chairman of the Board of Directors of African Export-Import Bank (Afrexim), Prof. Benedict Oramah, and President of European Bank for Reconstruction and Development (EBRD), Odile Renaud–Basso, in separate meetings, on the sidelines of the summit for New Global Financing Pact.

The President assured the delegation of AfreximBank executives that the Federal Government will continue to stimulate the economy with policies that support investments in areas of Nigeria’s competitive advantage, particularly agriculture.

“We need reforms for national survival,’’ he added, noting that it would take boldness and courage to reposition the economy, calling for more collaboration to solidify the economy.

“We must stimulate recovery for the growth and prosperity of our people, which will not be far away. Nigeria is ready for global business and our reform is total.”

The President of AfreximBank commended President Tinubu for the bold steps in removing the fuel subsidy and unification of the exchange rate, assuring the Nigerian leader of the full support of the financial and development institution on the ongoing reforms.

Oramah said the bank was already building the first African Specialist Hospital in Abuja, and Energy Bank, pledging to inject more money into the economy to further build confidence of investors.

In the meeting with EBRD, President Tinubu said: “We are challenged in terms of reforms, and we have taken the largest elephant out of the room with removal of fuel subsidy, and multiple exchange rates are equally gone. We are determined to open up the economy for business. Consider us a stakeholder in the bank.’’

Renaud-Basso said it would be a mistake for the development bank not to invest in Nigeria, after considering six potential economies for investment. She explained that focus would be on the private sector, especially Small and Medium-scale Enterprises (SMEs).

Joining other world leaders and heads of international organisations in Palais Brongniart in Paris for the two-day summit aimed at finding better ways to tackle poverty and climate change by reshaping the global financial system, President Tinubu said Nigeria and other African countries are committed to addressing the intertwined issues of climate change, poverty and fostering sustainable development.

The panel session titled: ‘Ensuring more reliable, comparable information and data,’ featured panelists such as: David Craig, Co-Chair of the Taskforce on Nature-related Financial Disclosures (TNFD); Mark Carney, Co-Chair of the Glasgow Financial Alliance for Net Zero (GFANZ); Mary Schapiro, Vice-Chair of Global Public Policy at Bloomberg; Sabine Mauderer, Vice-Chair of the Network for Greening the Financial System; and United Nations Special Envoy, Catherine Mckenna.

Tinubu said: “We believe we have more pressing social issues in Africa. The argument has been that world leaders should elevate social issues just like environmental issues. I must commend President Emmanuel Macron, who has brought the issue of poverty to the table. This summit is about climate, people and diversity.

“The severe financial and economic crisis that African countries found themselves in after COVID-19 is all over. There are economic difficulties, and we’ve all realised that public resources would no longer solve the problem, we need to track private capital and for us to track the capital, and we need to compete with other countries around the world.

“It is no longer business as usual for African countries, we now need to join the discourse. We need to compete with the rest of the world. We welcome the idea of President Macron to develop Net-Zero Data Public Utility (NZDPU) because we feel it is an open free repository that will greatly help African countries.

Welcoming the world leaders to Paris, the French President said the summit would focus on drawing up a new financial order that will scale up finances and support developing countries for energy transition, poverty reduction, while respecting the sovereignty of each nation.

Macron noted that African countries had been at the receiving end of the major global challenges, with debt hangovers that hamper growth and development. He told the leaders from 50 countries, multilateral institutions and the private sector that justice and fairness must be imperative in redesigning the new world financial architecture, with more focus on the most vulnerable.

“We must admit that no country can succeed alone in reducing poverty and protecting the planet,” he added.The French President noted that the private sector must be carried along in the new pact that seeks to harmonise growth, as they control most of the financial instruments that need to be liquified for more even development, especially on health, education and food security.

On behalf of African countries, the President of Niger Republic, Mohammed Bazoum, said the new pact must be “urgent” and “essential” to Africa, and the framework should be “just” and “robust” in reflecting the reality of developing countries as partners.

Bazoum said the challenges of impoverishment and desertification had stimulated unrest in most countries, affecting peace and stability in sub-regions and the continent. In Africa, we need support for infrastructure, health, food security and education,” he stated.

The United Nations (UN) Secretary-General, Antonio Guterres, told the gathering that the summit would need more mobilisation and political will for redesign and implementation.

The UN scribe said many countries were still struggling from effects of COVID-19 and climate change, and the war in Ukraine had heightened sufferings.

Guterres said some African countries had been unable to service their debts, with indications that generations might be affected. He said the new global financial pact must address fragmentations and frustrations, and enable the kind of change that encourages debt relief, suspension of repayments, change of business models and more commitment from development banks, with guarantees.

President Tinubu will today participate at the summit, which will unveil a New Global Financing Pact and mechanism for implementation. The summit aims to lay the groundwork for a renewed financial system suited to the common challenges of the 21st century, such as fighting inequalities and climate change and protecting biodiversity.

The New Global Financial Pact will define the principles and measures needed to reform the financial system and tackle the high levels of debt that prevent governments from implementing ambitious action to reduce the climate, economic and technological divides that risk fragmenting our world.

It will also pave the way for new agreements to tackle over-indebtedness and allow more countries to access the financing they need to invest in sustainable development, better preserve nature, reduce emissions and protect populations against the ecological crisis, where it is most needed.