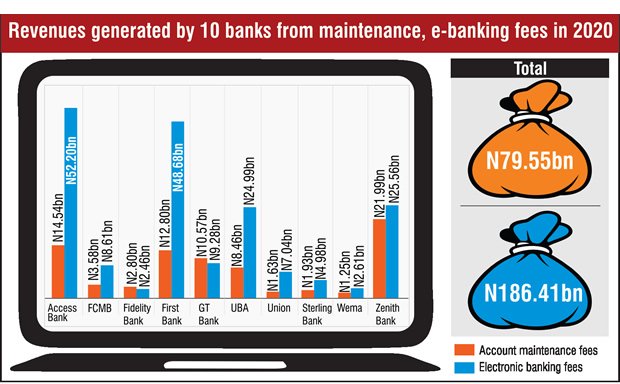

Ten Nigerian banks made N265.96bn from account maintenance and electronic banking fees in 2020.This is as shown by analysing data from the annual reports of the 10 banks. The banks made N79.55bn from account maintenance fees and N186.41bn from electronic banking fees.

The banks under review are Access bank, First bank, Guaranty Trust Bank, Zenith Bank, Fidelity Bank, Sterling Bank, Wema Bank, Union Bank, United Bank for Africa, and First City Monument Bank.

Of the banks under review, Zenith Bank made the most from account maintenance with N21.99bn while Wema made the least with N1.25bn. Access bank raked in the most from electronic banking with N52.20bn while Fidelity Bank made the least with N2.46bn.

In 2020, First Bank made N12.80bn from account maintenance, and N48.68bn from electronic banking fees. Access Bank made N14.54bn from account maintenance charge and handling commission and N52.20bn from channels and other e-business income.

According to Access Bank, channels and other e-business incomes include revenues from electronic channels, card products and related services.

GT Bank made N10.57bn from account maintenance charges and N9.28bn from e-business income.

Zenith Bank made N21.99bn from account maintenance fees and N25.56bn from fees on electronic products. FCMB made N3.58bn from account maintenance and N8.61bn from electronics fees and commissions.

Fidelity Bank made N2.8bn from accounts maintenance charges and N2.46bn from commission on e-banking activities.

Sterling Bank made N1.93bn from account maintenance fees and N4.98bn from e-business commission and fees. UBA made N8.46bn from account maintenance fees and N24.99bn from electronic banking income.

Wema bank made N1.25bn from account maintenance fees and N2.61bn from fees on electronic products.

Union Bank made N1.63bn from account maintenance fees and N7.04bn from e-business fees.

According to the Central Bank of Nigeria’s ‘The Guide to Charges by Banks, other Financial and Non-Bank Financial Institutions Current Account Maintenance Fee’ CAMF is applicable to current accounts only in respect of customer-induced debit transactions to third parties and debit transfers/lodgments to the customer’s account in another bank.

The CBN stresses that CAMF is not applicable to savings accounts and is negotiable subject to a maximum of N1 per mille.

The CBN also added guidelines for internet banking. It put N2,500 as the maximum cost for a hardware token. It said bills payment including bills payment through other e-channels should cost a maximum of N500. It gave a range of costs for electronic funds transfer.

It said transactions below N5,000 should cost N10; transactions between N5,001 – N50,000 should cost N25, while those above N50,000 should cost N50.

In its 2020, annual report, Access Bank said, “Our channels business has continued to record significant growth by taking advantage of the digital explosion accelerated by the pandemic.”

The bank added that it had over 13.1 million retail customers.

Access bank defined account maintenance fees as fees charged to current accounts. It said it charged N1 on every N1,000 in respect of customer induced debit transactions.

The bank added that the fees were earned by it at the time of each transaction.

GTB in its annual report said, “The COVID-19 pandemic also came during the time that the Central Bank released a revised guide to bank charges with significant impact on fees and commission line.

“The bank’s e-business income reported under the Fee and Commission line was the worst hit owing to the implementation of the CBN guidelines on NIP charges.”

Many bank customers complain that a number of fees charged by banks including accounts maintenance charges are burdensome.

However, a banker who spoke to our correspondent on condition of anonymity faulted the claim.

The banker said, “It costs the bank money to maintain accounts. Once an account is opened, it costs the bank money to maintain it.

“That is why when a customer doesn’t use their account for a time period, and the account goes into dormancy, the account is closed.

“This is because the bank doesn’t want to be paying for such accounts since it is not bringing anything to them.”

Savings account holders, however, are given negligible interest on their accounts.