Despite many challenges, there are indications that Nigeria, a leading African oil and gas producing nation, recorded many feats in 2023, due to the positive impact of the Petroleum Industry Act, PIA.

This is even as the nation’s 2024 outlook looks bright in medium and long term, according to available reports and experts.

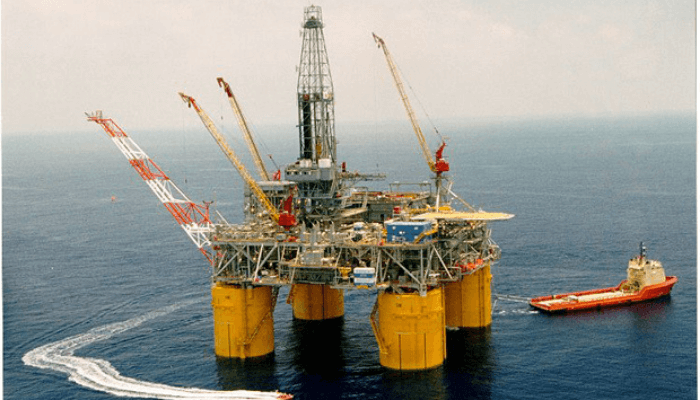

Meanwhile, the nation’s rig count, an index of measuring activities in the upstream sector, increased year-on-year, YoY, by 75 per cent to 14 in November 2023, from eight recorded in the corresponding period of 2022, according to data obtained from the Monthly Oil Market Reports, MOMRs, of the Organisation of Petroleum Exporting Countries (OPEC).

Also, on month-on-month, MoM, Nigeria’s rig count increased by 7.6 per cent to 14 in November 2023, from 13 recorded in the preceding month of October 2023.

Similarly, on YoY, Nigeria’s oil output rose by 1.7 per cent to 1.4 million bpd in November 2023, from 1.2 million bpd in October 2023, based on information obtained from secondary sources.

According to OPEC, this excludes condensate, light crude like Bonny Light, which Nigeria has the capacity to produce between 300,000 and 400,000 bpd.

The rise in output was partly fuelled by the return of Nembe crude produced by Aiteo, the Operator of the NNPC/Aiteo Oil Mining Lease (OML) 29 Joint Venture (JV), to the international crude oil market. Already, many cargoes of 950,000 barrels each have been exported to France and the Netherlands.

The NNPC Ltd continued oil search in the Lake Chad Basin in Borno State after it was stalled for over five years due to insurgency in the North East.

The company noted that the discovery of oil in viable commercial quantities in Kolmani River (upper Benue trough) between Gombe and Bauchi states last November gave positive signals for more efforts in Lake Chad.

Meanwhile, OPEC and non-OPEC Ministerial Meeting, ONOMM, has put Nigeria’s oil quota at 1.5 million bpd in 2024.

Previously OPEC had stated that, “Noting that Nigeria’s stated Production Plan in 2024 is 1,578 kbd subject to verification, and if verified then the number will be reflected as required production for 2024.”

Nigeria that adopted gas as a transition fuel has moved on to implement major gas projects. These include the new Ajaokuta Kaduna Kano (AKK) gas pipeline project and the NLNG Train 7 project.

The gas projects aim at commercialising the nation’s abundant gas for domestic use and export.

In the midstream, the NNPC Ltd technically completed the rehabilitation of Port Harcourt Refinery, adding that some tests, targeted at ascertaining the readiness of the plant to run commercial operations are ongoing.

The Group CEO, NNPC Ltd., Mr. Mele Kyari, said: “We are aware of our nation’s challenges in terms of fuel supply. But we are not here to give excuses. We are focused on delivering this rehabilitation project, our two other refineries, and all other investments towards revamping the nation’s refining capacity.”

Already, the $19 billion Dangote Oil Refining Company, which the NNPC Ltd., has 20 per cent stake, has taken delivery of about five million barrels of crude as part of preparation to commence test running and commercial operations.

According to the company, “Dangote Oil Refinery is 650,000 barrels per day (BPD) integrated refinery project under construction in the Lekki Free Zone near Lagos, Nigeria. It is expected to be Africa’s biggest oil refinery and the world’s biggest single-train facility.