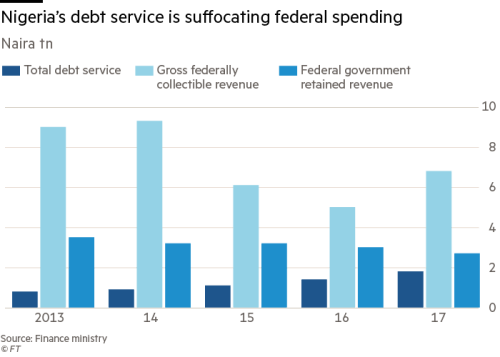

Nigeria is spending a quarter of its 2021 Budget on debt servicing, a trend that has continued for years.

With N3.3 trillion budgeted for debt servicing in the assented 2021 budget, Nigeria is poised to spend about a quarter (24.3 per cent) of the entire N13.6 trillion budget on debts, informed analysis has shown. This follows a trend that has been in place since 2016.

In 2016, the country spent almost a quarter (about 24 per cent) of its budget to service debts. Of the N6.6 trillion budgeted for 2016, the government earmarked N1.5 trillion on debt financing.

The sum of N1.6 trillion was proposed for servicing debts out of the total (N7.3 trillion) budgeted for 2017. And in 2018, the figure rose as N2.2 trillion or 24.17 per cent was pegged for debt servicing in the N9.1 trillion budget.

In 2019, the government proposed to spend 24 per cent (N2.14 trillion) of the N8.9 trillion expenditure on debt service.

Meanwhile in 2020, the Nigerian government proposed a spending plan of N10.3 trillion. Nearly a quarter of that amount (N2.5 trillion) was budgeted to service debts.

Debt payment Breakdown

Budget: Debt payments Breakdown

For the 2021 budget, the appropriation figure has been put at N3.3 trillion, an equivalent to 24.3 per cent.

2021 Budget

President Muhammadu Buhari signed this year’s budget on New Year’s eve, days after both chambers of the National Assembly passed the N13.6 trillion budget.

With the president’s assent, the bill has become law and the implementation is expected to commence in January for the 2021 financial year.

The legislators approved N13.6 trillion as against the N13.08 trillion proposed by the president in October last year.

A breakdown of the approved budget figures shows about N496.5 billion was approved for statutory transfers and N500 billion for stamp duty.

2021 approved budget framework

The recurrent expenditure was put at N5.6 trillion with capital expenditure pegged at N4.1 trillion and fiscal deficit at N5.2 trillion.

About a quarter (N3.3 trillion) of the approved budget was earmarked for debt servicing.

‘Unsustainable Trend’

Nigeria’s rising debt continues to put a lot of pressure on the government’s earnings and performance.

Verifications have shown that Nigeria has borrowed from local and international capital markets over the past four years to enable it finance its budgets and fund infrastructure.

In November 2020, Nigeria’s minister of finance, Zainab Ahmed, said total public debt stock comprising the external and home debts of the federal and state governments and the Federal Capital Territory stood at N31.01 trillion ($85.90 billion) as of June 30, 2020.

“It is projected, based on existing approval, to rise to N32.51 trillion by December 31, 2020 and N38.68 trillion by December 31, 2021,” she said.

Nigeria’s debt stock stood at N12.1 trillion as of June 30, 2015. This means the nation’s debt stock has risen by over 160 per cent in the last five years.

An analyst, Jide Ojo, said the “debt portfolio” is becoming unsustainable and the government needs to look inwards for other alternatives.

He attributed the huge amount spent on debt servicing as a ripple effect of the expensive cost of running governance.

“We don’t always have to borrow,” Mr Ojo said. “Some of the uncompleted white elephant projects (bogus projects that do not add value) can be auctioned off to complete projects that’ll add value to our economy,” he said.

“The government should also look at the possibility of utilising Private Public Partnership (PPP) to complete key infrastructural projects other than borrowing all the time.