The scarcity of the new naira notes took a worse turn on Monday as currency racketeers took advantage of the situation to exploit Nigerians who were desperate to obtain the currencies.

In Abuja, the nation’s capital, Lagos, Anambra and other states, black marketers were observed selling the new notes to those who could not endure the long queues at Automated Teller Machine stands.

A currency seller, Abdul Mohammed, operating under Dei-Dei pedestrian bridge in the Federal Capital Territory, said the inability of banks to distribute the new notes has increased the demand for them.

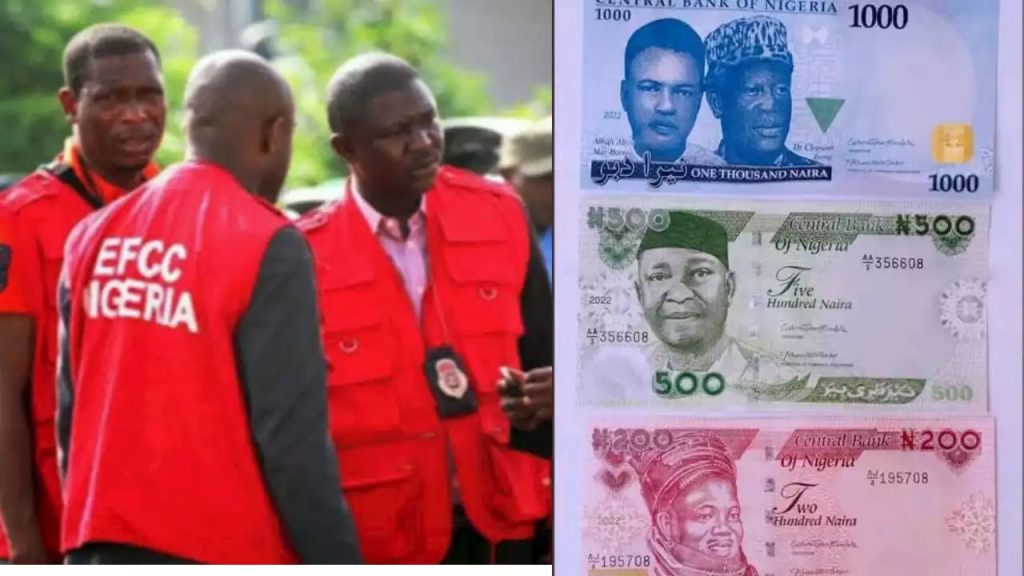

“We normally sell N10,000 for N13,000 and N20, 000 for N26,000. I will provide all the denominations you want. I have N200, N500 and N1,000 new naira notes,’’ he offered.

When asked if he could supply N600,000 new notes, he promised to notify our correspondent when the notes were available for collection.

He said, “The new notes are very scarce and that is why we charge more. Getting the new notes is very tough and expensive for us. The issue of changing the notes has caused a lot of problems. There is high demand for it. I get the notes at very expensive rates too.

“It is also not available at banks because people are rushing to buy it there; we are not enjoying the business at this time.

“We sell a bundle of 200 notes for N300,000; N500 is even cheaper than that. Some get it from the bank but it gets exhausted quickly.”

A currency exchange operator, who chose to remain anonymous, explained that the currency exchangers maintain a relationship with bank staff, adding, however, that they do not pay for the currencies, except by way of incentives or when there is an increase in demand.

“Currency exchangers basically form relationships with bank staff. If I need an amount, all I do is put a call through to my contact in the bank, ask for the availability of what I need, find out the buy rate, and buffer it by N5-N10 to resell.

“Most times, we don’t offer the bank staff anything. We just give incentives once in a while. Except there is high demand and limited supply, that’s when they can demand something. N50,000 mint (new notes), for example, could resell for about N53,000 or N60, 000, at most,’’ he explained.

Anambra

Banks in Onitsha, Nnewi, Obosi, Nkpor, Ekwulobia and some parts of Awka in Anambra State did not open as a result of the Monday sit-at-home.

One of our correspondents, who went round the cities, noticed that most of the ATMs were switched off while the few ones that were working were still dispensing the old notes even as they were besieged by a huge crowd of customers.

In the early hours of Monday, our correspondent gathered that two persons who had a public address system, went around some streets of Onitsha and Nkpor, asking the residents to come out and buy the new notes.

The unidentified individuals were said to have insisted on collecting N3,000 on every N10,000 withdrawal of the new notes.

Lagos

Our correspondents who visited some parts of Lagos and Ogun states, including Ikeja, Egbeda, Ikotun, Idimu and Magboro, observed that the racketeers had taken over the naira swap initiative in alleged deals between them and some bankers.

It was observed that the currency racketeering was on full display at Access Bank located on Ikorodu Road in Lagos on Monday.

A resident, who chose to speak on condition of anonymity, said, “I went to the Access Bank to withdraw some money. Out of all the nine Automated Teller Machines on the bank premises, only one was dispensing the new notes with a N20,000 withdrawal limit.”

“However, due to the long queue of customers on the bank premises, a woman whom some people had accused of using different ATM cards to empty a nearby Zenith Bank machine began to sell the new notes to those who could not withstand the long hour on the queue,” she narrated

According to her, the lady charged N1,000 per N10,000 and N5,000 per N100,000 for the new notes.

Similarly, during visits to some PoS operators in Ogun and Lagos, some residents narrated how they bought the new notes from bankers and black market operators.

A PoS operator at Berger bus stop told a journalist they could not get the new notes from banks due to the scarcity.

She further alleged that some bankers and black market operators were selling the new notes at outrageous rates, making it difficult for them to maintain the previous charging rates.

She said, “We cannot continue to charge our customers the previous rate. Some bankers sell the new notes to us. At times, we get them from the black market. On every N100, 000 new notes we collect, there is a charge of N5,000. Some currency operators charge as high as N10, 000 for N80, 000.”

She warned that they might no longer engage in a transaction that is less than N5,000.

At a PoS shop at Berger, our correspondent observed the fee had increased astronomically.

Also, one Iya Ire, who operates a PoS terminal at the Egbeda area of Lagos State, said, “Here, they sell new notes; N5,000 comes with an extra charge of N500 and above, depending on how you negotiate. Then for N10, 000 new notes, it comes with an extra charge of from N1,000 and upwards”

One of the black market operators in Ikeja who does not want her name on print said, she charges as much as N500 for N5000 cash withdrawal.

She said, “I had to pay the cashier at the bank to get the new notes and that’s even because I’m a regular customer at that branch. Even at that, I still spend hours in the banking halls.

Narrating his ordeal, a PoS operator in the Magboro axis of Ogun State, Tunji Samuel, said, “Can you see how I am sweating? I have just returned from the bank. I was unable to get the new notes at the bank.

Meanwhile, around Sterling Bank in the Magboro area of Ogun State, unlicensed currency operators were spotted selling the new notes.

One of the operators charged our correspondents N500 for a N5000 cash withdrawal.

Another currency hawker, who chose to speak on condition of anonymity, said, “I am helping a staff member of the bank to sell new notes and I get a commission after sale.”

At the Computer village, in Ikeja, Lagos State, it was observed that a number of shop owners were selling new notes to customers.

One of the shop owners said, “I have been gathering the new notes for two weeks now. I was lucky to get some at a party I attended on Saturday. However, I had to pay some fees to buy additional new notes. I’m glad I am making some profit from this.”

Also, Point of Sale operators in the Ikeja area of Lagos State were charging as much as N500 for every N5000 cash withdrawn.

Abuja operators

In Abuja, one of our correspondents paid N1,000 as fee to withdraw N10,000 new notes from a PoS agent.

However, scores of bank customers were subjected to long queues at ATM stands in Maitama, Wuse II, Garki and other locations across the Federal Capital Territory.

The same situation was witnessed at the branches of Guaranty Trust Bank Plc, Zenith Bank Plc, Stanbic IBTC, Sterling Bank, First City Monument Bank and First Bank, among others in the area.

Our correspondent learnt that the long queues were worsened by the ban on over-the-counter withdrawal of new notes in banks.

It was observed that the crowds at the GTBank branch in Jabi and Zenith Bank in the Central Business District, were larger than those of last week. However, it was observed the banks’ ATMs dispensed the new notes.

The situation was the same at the Airport and Jabi branch of Zenith Bank as our correspondents were turned back at the gate.

An official on duty simply said, “You can’t make withdrawals.”

In the Bwari Area Council, PoS agents charged as much as N500 for N5000 cash withdrawal and N1,000 for N10,000.

However, the operators in the Wuye axis demanded N1,500 for cash withdrawals of N15,000.

Defending the hike in charges, a female PoS agent stated, “We are charging that amount because it is not easy to get it (new notes). Most times, we stand from morning till evening to get it and the limit is just N20,000.

On how they get above the limit, she said, “I pay to get it; I spend at least N400 on every N10,000 transaction because I have to use other people’s ATM cards. I would transfer the amount I need to someone’s account, add the bank charges and withdraw it bit by bit. I still have to settle the people whose accounts were used to make the withdrawal.”