Bank customers have lamented continued lack of the redesigned banknotes at Automated Teller Machines (ATMs) and over-the-counter transactions. They said the poor circulation was not good for business.

Bank customers said the limited circulation of the banknotes could put them under pressure in view of January 31, 2023 deadline set to return all old notes to the banks.

Moses Adigun, a Lagos-based entrepreneur said it was nearly two weeks since the new notes began circulation, but he is yet to receive even one.

“I keep hearing that there is new banknotes in town but I have not even touched one of them. This will make it difficult to beat the January 31 deadline for all old notes to get to the banks,” he said.

Also speaking, Michael Obinna, a provision store merchant, said he has only received N1,000 note from one customer.

“I have only received N1,000 note from a customer who came just yesterday. I think the circulation of the new notes is very poor,” he said.

An economist, Tope Fasua, gave another view to the scarcity of the new bank notes.

He said the scarcity of the banknotes could be a deliberate policy plan by the Central Bank of Nigeria to strengthen the naira.

He said: “People have speculated that the CBN will not print all the N3.2 trillion it is taking out of circulation and that makes sense. Scarcity of naira at some point may lead to people changing their dollars back into naira cash just to live their normal lives, thus strengthening the naira”.

“Scarce naira cash, coupled with the new innovations that the CBN is bringing up such as the naira domestic card will also lead to better adoption of e-banking. In the UK for years now, a third party cannot pay cash into any account. In most countries they have since gone contactless”.

Fasua explained that somehow the naira redesign move now has multiple implications and is not only about operational counterfeiting issues but also a window to establish a better trajectory for the naira in terms of its value.

“The Central Bank must seize this opportunity and I also advise President Buhari to do the same. In Economics we always talk about unintended consequences. The first phase was the slump in the value of the naira as people moved money from their soak-aways to buy foreign currency, especially those who are too criminal to put same in a bank. A second phase could be marked by the strengthening of the naira in that same black market,” he said.

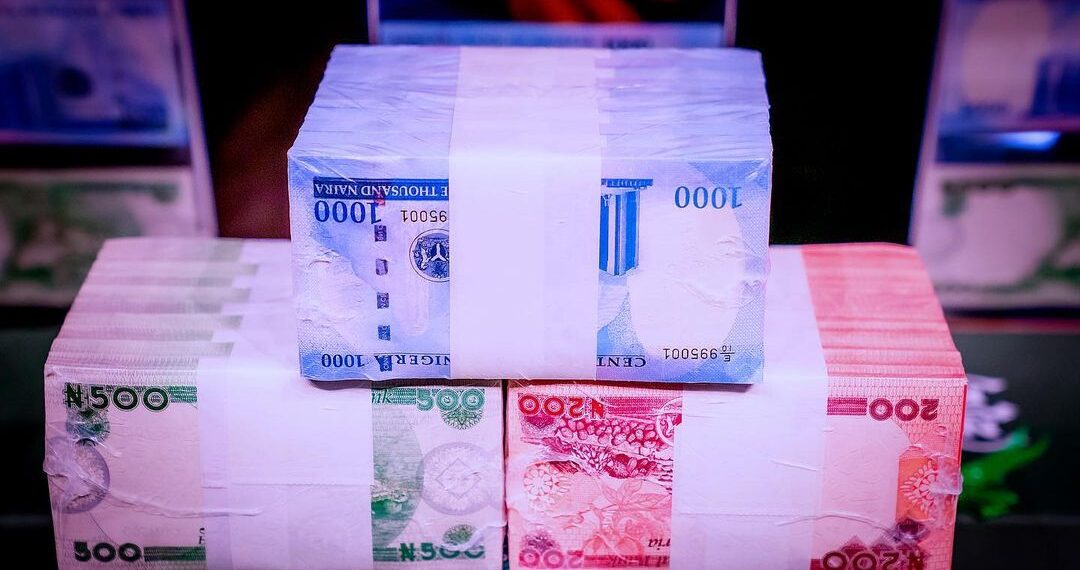

The Deposit Money Banks (DMBs) had on December 15, commenced payment of their customers with new naira notes as directed by the Central Bank of Nigeria (CBN).

However, the limited volume of the new notes made available to banks prompted the tellers to mix the old and new naira notes for over-the-counter transactions customers.

A customer service officer in a Tier-1 bank, who spoke anonymously said: “The tellers were asked to mix the funds. For large volume withdrawals, only 10 per cent of the funds will be in new notes. I think it will get better with time,” she said.

Many Automated Teller Machines (ATMs) in Lagos still dispensed old naira notes on the first day the new naira note began circulation.

Although the Central Bank of Nigeria (CBN) said it has commenced distribution of the newly redesigned Naira notes to Deposit Money Banks across the country, commercial banks in major cities in Nigeria are still struggling with limited availability as they began dispensing a few redesigned naira notes to over-the-counter customers.

CBN Governor, Godwin Emefiele recently said the new currencies have now reached the banks and it is expected that the banks will soon distribute those currencies to the members of the public who are their customers.

Emefiele had said the new notes and old notes will operate together for some time, maybe that is the reason they are paying in both old and new notes.