Lekoil Nigeria Limited has said that it is raising $100 million before it can start drilling in its Ogo oilfield. The company says that it has reached a deferred payment deal earlier this year to keep its stake in OML 310, where Ogo sits, after it discovered a $184 million loan it wanted to use for the purchase was fraudulent.

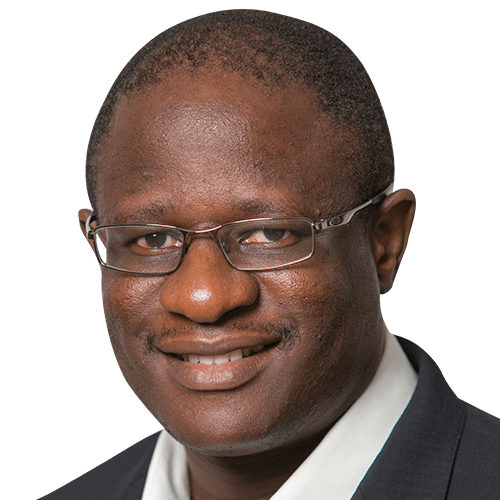

The Chief Executive of Lekoil Lekan Akinyanmi said the company was able to finance much of the Ogo preparation work with cash from its producing field, Otakikpo, and will drill once it raises the money. Lekoil is in talks for a mix of direct investment into the asset and vendor financing, which Akinyanmi said is the most cost-effective way to raise money for drilling. He expects to spend $1 billion developing Ogo through its life cycle.

“We want Ogo to raise its own capital so that we can actually start to build cash…and maybe in a few years start to pay dividends,” he said, adding that Otakikpo, which produced an average of 5,305 barrels per day (bpd) last year, yielded $15-$16 million in free cash. Shares in London-listed Lekoil plunged in January after it revealed the loan that it thought was from the Qatar Investment Authority (QIA) was a “complex facade”.

In results published this week, Lekoil posted a $12 million loss in 2019, compared with a $7.8 million loss in 2018. Its cash balances dropped to $2.7 million from $10.4 million. Lekoil is also targeting a 40% reduction in annual general and administrative expenses due to this year’s oil price crash.