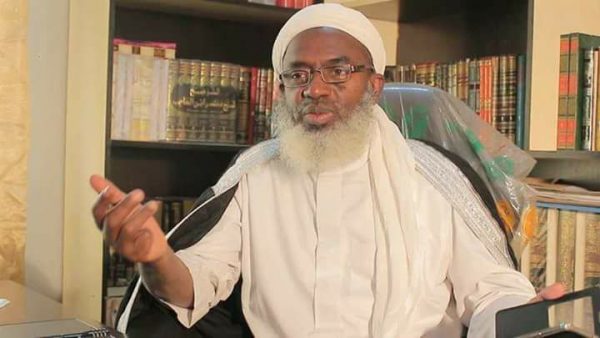

By Dr. Ahmad A. Gumi

It is a certainty that the nation is facing an unprecedented economic crisis. The Government has ordered that all capital projects can only be cashed half from the current budgetary provision. The national debts have reached a ceiling economist are convulsing over the impending consequence of its future burden and economic stagnation that will ensue.

In this pathetic situation, the government through the central bank is trying to give an interest-free loan to some Muslims in Nigeria on the premise that interest on loans is the usury forbidden by Islam, and therefore in the fairness of inclusiveness, Muslims should also enjoy what is halal for them. Unwontedly, there is the only extent where their ‘Islamic’ claims stop.

Banking is an economic innovation that has nor religious connotation neither Judaism nor Christianity nor Islam. Like many modern innovations in communication, transportation, medicine, and architecture. Efficiency is the driving force and motivation not greed as they malicious say. Ironically, none of these religions have provided the media for such rapid development in science, the backbone of economic explosion and expansion like Islam.

Muslims taught the West mathematics, physics, astronomy, and medicine before going into intellectual slumber and decay. As we are awaking, some scholars rousing up, only to see great advancement before them, do realize that Muslims have missed the road of temporal development somewhere (and even the spiritual one). Others see the only way is to go back to ancient times and start from the beginning.

Interest-free loans were never an economic tool. In it, there is always a beneficiary and a loser. If the idea of giving interest-free loans is philanthropic that is a very good idea, the loser who is the giver, depending on his intention doesn’t require any material reward from his actions.

If however the giver, equally bankrupt and in need of cash, then it’s a Pandora’s box. In Islam, loans of real money in contrast to fiat money should never incur interest and it should be given not as an investment but as philanthropic. That is why the Quran said:

{وَإِنْ كَانَ ذُو عُسْرَةٍ فَنَظِرَةٌ إِلَى مَيْسَرَةٍ وَأَنْ تَصَدَّقُوا خَيْرٌ لَكُمْ إِنْ كُنْتُمْ تَعْلَمُونَ} [البقرة: 280]

“If the debtor is in a difficulty, grant him time Till it is easy for him to repay. But if ye remit it by way of charity, that is best for you if ye only knew.” Q2/280.

This is the complete prescription of the usury prohibition as stipulated by the Quran. In case of default on usurious loans, the respite is indefinite. This is definitely not an economic prescription but philanthropic. For this reason, the so-called ‘Islamic’ banks are notoriously characterized by lack of giving out loans to others but are ready to collect deposits from naive faithful on their own terms.

In most materially developed nations, it’s the private banking that finances business from manufacturing, agriculture, and trade. They share the profits with governments in terms of taxes and government provided for then insurance in case of losses, gaining a shock-absorber effect, and giving the economy a smooth run.

So why did Muslims failed to develop the interest-free banking they claimed as most profitable privately to prop up the economic situation of the majority Muslims time immemorial if such claims are true?

Bank loans are pure investment loans. They are called loans, but actually, they are investment shares. They are what is equivalent in Islamic jurisprudence to what is called Qiraad i.e project financing for a profit. This is different from a company whether in form of Mudarabah, Murabaha etc. as most contemporary ‘Islamic’ economists are confused about. In Islamic company law, both partners must contribute is cash and labor (work).

While in Qiraad, one of the partners is the financier while the other provides the labor (work), and they share profits and losses according to their agreement. It was established by ijma’ i.e. consensus because of necessity not by Quran or sunnah.

One may say, the present modern banking does not equally follow all the rules laid down by fuqaha in such transactions. Yes because of changing times. Likewise, in Mudarabah, Murabaha, etc of Islamic banking. First and foremost, fiat money is not allowed to be used as capital in Mudarabah except with Ahmad. Profit and loss should be shared in equity therefore a partner can lose all his investments at a go. In modern times, the law of necessity then allows, creation of new measures to protect wealth and promote growth, which is all that modern banking is doing.

Because of the importance of banking to the economy, when banks are failing, governments go to their rescue with bailout money and liquidity infusions. Of course, if such failures are not due to corruption and incompetence, in which case they are liquidated.

Islam is a religion of justice. If the government decides to give out interest-free loans as a philanthropic measure, like the infamous trader-money, N-power etc., then it should consider every Nigerian irrespective of his religious status. If on the other hand, it’s for religious reasons, then the government should also know that in cases of default it has no right to pressure any debtor to payback indefinitely.

As for those scholars clamoring governments for interest-free loans, they have missed the crux of the matter. No government can sustain losses from such loans because of the issues of default, devaluation of currencies, inflation, and fraud. Just like Islamic banks are not liberal with these ‘interest-free’ loans because they are inefficient, impracticable, and sometimes deceit. Some of such banks take their calculated interest in advance of the loan.

If the government will answer you to give you such interest-free loans. Then it is only a political stunt and only a few may enjoy it for some time, and like the other financial palliatives ‘fizzle out’ in no time.

The way out of our predicament is the opposite of devouring Usury which is Sadaqat. Allah said:

{يَمْحَقُ اللَّهُ الرِّبَا وَيُرْبِي الصَّدَقَاتِ وَاللَّهُ لَا يُحِبُّ كُلَّ كَفَّارٍ أَثِيمٍ} [البقرة: 276]

“Allah will deprive usury of all blessing, but will give increase for deeds of charity: For He loveth not creatures ungrateful and wicked.” Q2/276.

The Zakat and voluntary alms-giving. The Nigerian supreme council of Islamic affairs, with the patronage of the Sultan, should be electing executive members, and a strong Zakkat and endowment committee should be established with branches in each state to collect Zakat from rich individuals. Henceforth every Muslim should pay his Zakat to this central body which will manage it.

They can invest the money and also take care of the needy and poor by giving them free loans to establish themselves. If this is implemented -Insha Allah-, in no time, poverty will be a thing of the past in our poverty-stricken population.

Meanwhile for those who can secure loans from conventional banks should do so and use it judiciously to establish factories, farms, etc. it’s not philanthropy for going to Umra, hajj, and marrying more wives.

As a general rule in Islamic transactions, the prophet- alaihis salam- said:

:لا ضرر ولا ضرار

“No mutual damage should two parties incur”

Today, because fiat money is used in transactions, an interest-free loan or I call it investment loan is damaging to the lender (or investor).

May Allah guide us to his pleasure. Amin.

Sheikh Gumi is an internationally recognize renowned scholar in Islamic jurisprudence and a medical doctor by training