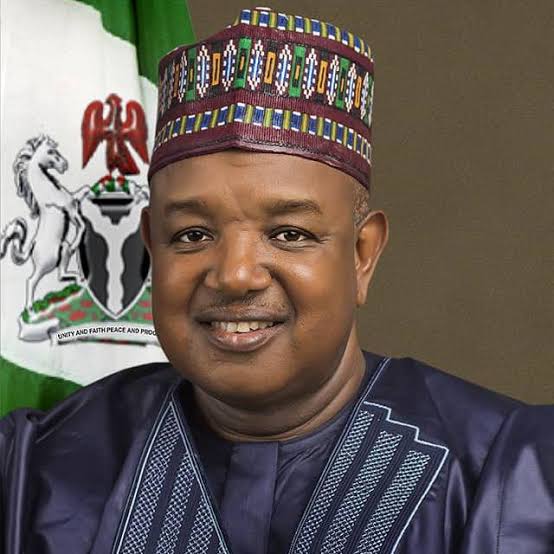

The Minister of Budget and Economic Planning, Atiku Bagudu, says the decision to base the 2024 budget on foreign exchange benchmark of N800 to a dollar was a strategic and conscious decision by the Federal Government.

In an interview with journalists on Thursday in Abuja, Mr Bagudu said budgets could not be based on a spot rate in order to avoid eventualities in the world market due to global dynamics.

He said before arriving at the projected exchange rate of N750 to the dollar in the 2024 budget, the government considered and viewed critically the average performance of the Naira.

The National Assembly eventually raised the foreign exchange benchmark to N800 to the dollar.

“For budgeting purposes, you don’t use the spot rate of anything. Oil price can go to 120 today, maybe there is a shortage, maybe there is a collision between two ships that will block a channel. It would be foolish to use that as a reference price.

“I should take a period of maybe six months to one year and say let me observe this average behaviour, so you don’t use spot prices. So, even the exchange rate is like that.

“Much as we are hoping that it would soon come below, but at the time you are doing the budget you will take a view on average performance. And that’s what we took,” Mr Bagudu said.

The minister said the federal government was confident that the measures taken so far would substantially increase the supply of foreign exchange into the economy.

The budget minister, who also spoke on the level of borrowing to fund the deficit in the 2024 budget, said the difference between this year’s borrowing compared to 2023 remained significant.

“In 2023, the budget anticipated a borrowing of close to N14 trillion. This year’s budget is N9.1trillion. So, we think that is significant.

“2023 took us to about 6.11 per cent of our GDP as borrowing. This one is 3.8 per cent. So, the quantum had decreased,” he said.

Mr Bagudu said the federal government in the 2024 fiscal year intended to operate strictly within the dictates of fiscal responsibility law.

The law provides that the Central Bank of Nigeria can lend to the government through its Ways and Means window only five per cent of total budget.

“We will not go outside the law and borrow from ways and means, what is outside the law.

“So, the fiscal responsibility law says, in every one year, the Central Bank can lend the government up to five per cent of its budget for the year.

“So, if you go out of that, you’re going outside the lawful limit, and that’s what the minister of Finance and Coordinating Minister of the Economy was very clear about we are not going to do. We are not going to resort to borrowing outside the law,” he said.

Mr Bagudu said 2024 revenue projections were designed to build on the various initiatives of the government to create an enabling environment for investment from both the local and foreign businesses.

He said the core priority of the budget was placed on areas such as security, education, works and housing in order to develop the economy and create jobs for Nigerians.

Bagudu said: “We have seen the reforms so far have brought in more revenue but we are not stopping there. We believe that our objective to achieve at least 1.8 million productions per day is something that has been done before. And with security gains that are increasing with mobilising of all stakeholders.

“For example, just yesterday, maybe you will have seen even the governors re-energise the National Economic Council Committee on crude oil theft and prevention so that governors will say to the extent that is happening in their state, they will take personal responsibility and lead.

“So, because of that we are confident that the revenue projections are achievable and with budget efficiency and discipline we are putting in, we believe that we won’t have to resort to additional borrowing. Maybe we will even borrow less.”