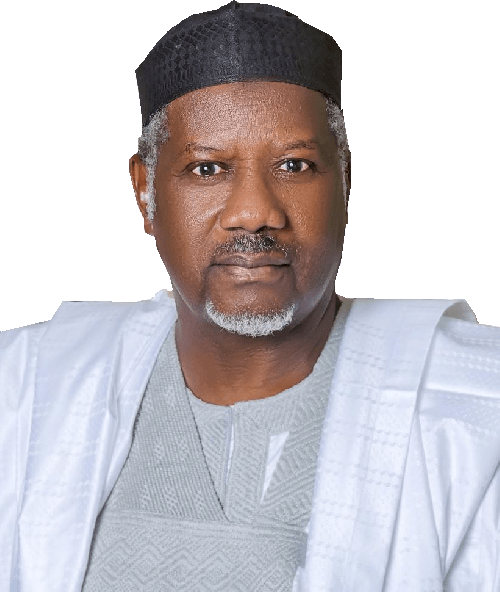

The President of the Manufacturers Association of Nigeria (MAN), Mr. Mansur Ahmed, has commended the Central Bank of Nigeria (CBN) for creating a N100 billion intervention fund for the pharmaceutical industries in the country. Ahmed, who spoke on Tuesday during a capacity building forum organised by the Finance Correspondent Association of Nigeria (FICAN) in Lagos, saying: “I think the CBN has done a wonderful job by creating this intervention fund, which will go a long way at expanding the capacity of our members.

“I would, therefore, wish to use this opportunity to appreciate the Governor of the CBN, Mr. Godwin Emefiele, for the wonderful opportunity given to our members; the manufacturing sector as a whole and the development of the Nigerian economy in general.

“We would further assure the CBN that members would complement the effort of the government by utilising the fund to develop the industry and provide the necessary platform for Nigeria to compete with her peers in the industry within the African continent as we approach the single market for Africa through the implementation of the African Continental Free Trade Area (AfCFTA) agreement next year.”

He said about 10 companies had accessed the fund, stating that the CBN is not responsible for any delay in accessing the fund.

“As at now, and from the information available to MAN, only 10 members in the industry have obtained the facility. This was not due to lack of funds or any technical hitch from the CBN. But investigation revealed that some of them have not been too willing to take the facility of a huge sum as provided by this scheme.

“Another reason is that many are still trying to perfect their document; given the technical details required by CBN as being administered through the Participating Financial Institutions (PFIs).

“I believe some other companies in the industry who are yet to obtain the facility are only trying to put things in order and whenever such are ready, the funds are there for them to access as graciously provided by the CBN,” Ahmed said.

He disclosed that some of the conditions attached to the loan for working capital included a maximum period of one year with provision for rollover not more than three years while the tenure of the loan has a maximum tenor of not more than 10 years with a maximum of one-year moratorium on repayment.

Ahmed said the intervention fund, which was meant to cushion the harsh effects of COVID-19 on the healthcare industry, would provide credit to indigenous pharmaceutical companies and other healthcare value chain players at five per cent to build or expand their capacity.

“It is expected to increase private and public investment in the healthcare sector, facilitate improvements in healthcare delivery and reduce medical tourism in order to enhance foreign exchange conservation,” he said.