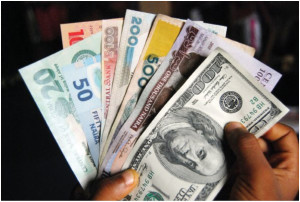

Following the Central Bank of Nigeria’s (CBN’s) decision to ban the sale of foreign exchange to Bureau de Change operators, the apex bank’s policy has taken its toll on the market. On Tuesday, barely 24 hours after the ban was announced, the Naira exchanged for N300 against the United States dollar in Kano, while Lagos and the Federal Capital Territory, Abuja hadN290 and N292as their exchange rates respectively.

Following the Central Bank of Nigeria’s (CBN’s) decision to ban the sale of foreign exchange to Bureau de Change operators, the apex bank’s policy has taken its toll on the market. On Tuesday, barely 24 hours after the ban was announced, the Naira exchanged for N300 against the United States dollar in Kano, while Lagos and the Federal Capital Territory, Abuja hadN290 and N292as their exchange rates respectively.

The Naira was trading at N285 against the dollar at the parallel market before the ban was announced on Monday, January 11.

Aminu Gwadebe, Acting President, Association of Bureau de Change Operators, said: “there is cut of (dollar) supply to the market. The BDC sub-sector has been murdered. We are not coping. The Naira is going to head northwards. There is no solution in sight.”

Ayodeji Ebo, Head of Investment Research, Afrinvest West Africa Limited, said the stoppage of forex sale to the BDCs would create significant spike in the value of the Naira at the parallel market. “It will further compound or increase the spread between the parallel market and the inter bank market. So, it will also increase round-tripping and unethical practices within the financial system,”he said.

Similarly, Leo Ukpong, professor of financial economics, University of Uyo, Akwa-Ibom State, did not think that the stoppage of dollar sale to the BDCs will solve the problem. “This move will make the Naira to weaken more as demand for dollar will skyrocket because of the short supply.”

By Dike Onwuamaeze